Before applying for Rockport auto title loans, understand requirements like age, valid driver's license, vehicle ownership free of liens, passing inspection, and income/debt assessment. Compare with Dallas title loans options. Verify lender credentials through state licensing and online customer feedback. Thoroughly compare loan terms, interest rates, repayment periods, and fees from various Rockport auto title loans providers. Beware restrictive requirements or harsh credit check policies.

“Uncovering reliable Rockport auto title loan providers is a crucial step in securing funding for your needs. This comprehensive guide will lead you through the process of recognizing reputable lenders in the competitive market. We’ll explore essential factors like understanding local regulations and requirements, verifying lender credentials through customer reviews, and critically comparing loan terms to ensure fairness. By following these steps, you can make an informed decision when seeking Rockport auto title loans.”

- Understanding Rockport Auto Title Loans Requirements

- Verifying Lender Credentials and Reviews

- Comparing Loan Terms and Conditions for Fairness

Understanding Rockport Auto Title Loans Requirements

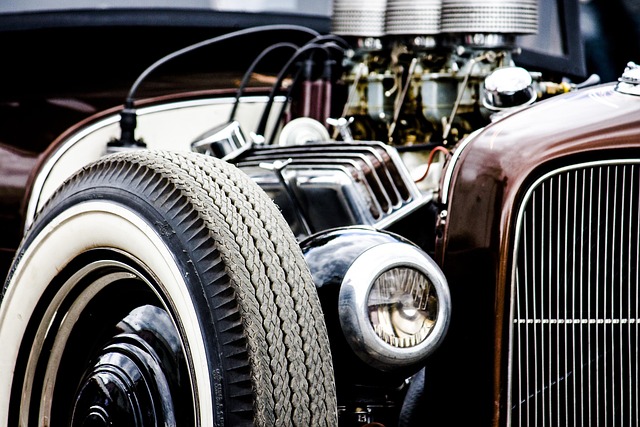

When considering Rockport auto title loans, understanding the requirements is a crucial first step. Lenders typically require you to be at least 18 years old and have a valid driver’s license to apply. Additionally, you’ll need to own a vehicle free of any outstanding liens, as this serves as collateral for the loan. The car must also pass a basic inspection to ensure its condition meets the lender’s standards.

Emergency funds or immediate financial needs can be met through Rockport auto title loans, but it’s essential to assess your repayment capacity. Lenders will evaluate your income and debt-to-income ratio to determine if you can afford the monthly payments. Comparisons with other options like Dallas title loans can help you decide, as car title loans often have simpler eligibility criteria but higher interest rates.

Verifying Lender Credentials and Reviews

When searching for a Rockport auto title loans provider, verifying the lender’s credentials and reviews is a crucial step to ensure a safe and reliable transaction. Start by checking if the lender is licensed and regulated by the relevant authorities in your state. This ensures that they adhere to legal standards and consumer protection guidelines. Many states have specific requirements for auto title loan providers, so make sure the lender meets these criteria.

Next, turn your attention to online reviews. Customer feedback offers valuable insights into a lender’s reputation and the quality of their services. Look for reputable review sites where borrowers share their experiences with Rockport auto title loans providers. Positive reviews indicating fair interest rates, transparent terms, and excellent customer service are strong indicators of a trustworthy lender. Remember, a lender that values its customers will typically encourage feedback and maintain an open line of communication, allowing you to keep your vehicle while accessing emergency funds during challenging times.

Comparing Loan Terms and Conditions for Fairness

When considering Rockport auto title loans, comparing the terms and conditions offered by different lenders is vital. This involves examining interest rates, repayment periods, and any additional fees charged. A fair lender will provide transparent information about all costs associated with the loan, allowing borrowers to make informed decisions. Look out for loan requirements that are too restrictive or unreasonable, as these could indicate a less reputable provider.

Moreover, understanding the credit check policies is essential. Some lenders may have stringent credit checks, which can be problematic for individuals with poor credit histories. Others might offer more flexible options, especially when it comes to loan refinancing. This feature allows borrowers to adjust their repayment terms if their financial situation changes. By carefully evaluating these aspects, you can identify a reputable Rockport auto title loans provider that aligns with your needs and offers fair practices.

When seeking Rockport auto title loans, it’s crucial to navigate the process with diligence. By understanding the requirements, verifying lender credentials through reviews, and comparing loan terms, you can ensure a reputable and fair transaction. Remember, a reputable provider is essential for a positive borrowing experience, so take the time to research and choose wisely among the various Rockport auto title loans options available.