Rockport Auto Title Loans provide quick funding secured by a vehicle's equity, offering an alternative to traditional banking for those with limited credit options. To qualify, borrowers must own a vehicle, have valid registration, and demonstrate stable income from employment history or tax returns. These loans are ideal for individuals seeking swift financial solutions but require understanding of interest rates and potential fees before application.

“Rockport auto title loans have emerged as a viable financial option for many. This article guides you through the process, offering insights into how to assess your eligibility. Understanding the specific criteria and income requirements is crucial before applying for a Rockport auto title loan.

We break down the key factors, ensuring you’re informed about what lenders look for. From meeting basic eligibility criteria to verifying income, this comprehensive overview will empower you to make informed decisions regarding your financial needs.”

- Understanding Rockport Auto Title Loans

- Eligibility Criteria for Loan Access

- Income Requirements and Verification

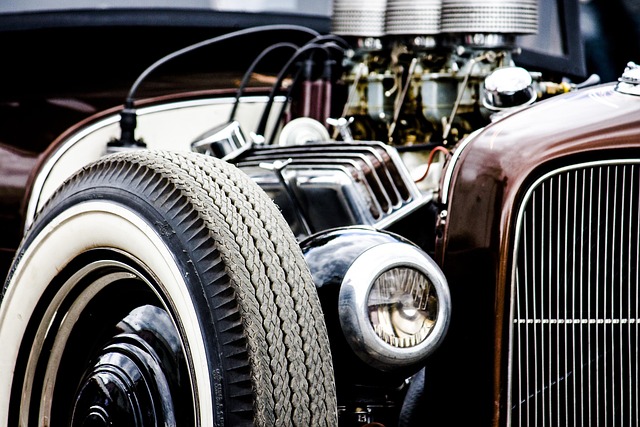

Understanding Rockport Auto Title Loans

Rockport Auto Title Loans are a unique financial solution designed to help individuals access funds quickly by using their vehicle’s equity. These loans are secured against the vehicle, meaning the lender holds a lien on the car’s title until the loan is repaid. This type of lending offers an alternative to traditional bank loans and can be particularly beneficial for those with poor credit or limited banking options. The process involves evaluating your vehicle’s value and equity, ensuring you own the vehicle free and clear, and confirming your ability to make consistent repayments.

Unlike unsecured loans, Rockport Auto Title Loans provide a guaranteed funding amount based on the appraised value of your vehicle, up to a certain limit. Once approved, the lender will transfer the title to themselves temporarily, a process known as a title transfer. This ensures the lender’s security interest and allows them to repossess the vehicle if payments are not met. However, once the loan is fully repaid, the title is returned to the borrower. It’s essential to understand the terms and conditions, including interest rates, repayment periods, and potential fees, before taking out a Rockport Auto Title Loan to ensure it aligns with your financial needs and capabilities.

Eligibility Criteria for Loan Access

To be eligible for Rockport auto title loans, borrowers must meet certain criteria set by the lending institution. Firstly, they should own a vehicle with a clear and valid registration. This ensures that the lender has collateral to secure the loan. Additionally, applicants need to provide proof of income, demonstrating their ability to repay the loan. The requirement varies but typically includes employment verification or other forms of stable income streams.

The process is designed to offer a financial solution for individuals who may not have perfect credit or traditional loan options available to them. Unlike some other loans, Rockport auto title loans do not conduct extensive credit checks, making it accessible to a broader range of borrowers. This also means that even with less-than-perfect credit, individuals can still secure quick funding if they meet the basic eligibility criteria and have a clear vehicle title.

Income Requirements and Verification

When applying for Rockport auto title loans, understanding the income requirements is essential to ensure a smooth application process. Lenders will verify your financial stability and ability to repay the loan before approval. This verification typically involves examining your income sources, employment history, and overall creditworthiness.

For Rockport auto title loans, or car title loans in general, lenders are keen on assessing your Loan Requirements. They look for a consistent and reliable income stream that can support repayment. This could include salary slips, tax returns, or other official documents detailing your earnings. A title pawn is often used as collateral, ensuring the lender has security for the loan. Therefore, demonstrating a stable financial position is crucial to increase your chances of approval.

Rockport auto title loans can be a viable option for those seeking quick funding, but understanding the eligibility criteria and income requirements is essential. By meeting these standards, borrowers can navigate the process with confidence and access the financial support they need without delay. This summary highlights the key aspects to consider when evaluating Rockport auto title loans as a potential solution for your immediate financial needs.