Rockport auto title loans offer quick financial assistance using a vehicle's title as collateral. Borrowers should compare lenders focusing on competitive rates, flexible terms, transparency, and positive customer reviews to ensure reputable and beneficial borrowing with reliable repayment options.

In the market for a Rockport auto title loan? This guide is your compass. We’ll navigate you through the process, starting with the fundamentals of Rockport auto title loans and the key factors to consider when choosing a lender. From understanding interest rates and terms to leveraging tips for securing the best deal, this article ensures you make an informed decision. By following these strategies, you’ll confidently navigate the landscape of Rockport auto title loans.

- Understanding Rockport Auto Title Loans: Basics Explained

- Key Factors to Consider When Choosing a Lender

- Top Tips for Securing the Best Rockport Auto Title Loan Deal

Understanding Rockport Auto Title Loans: Basics Explained

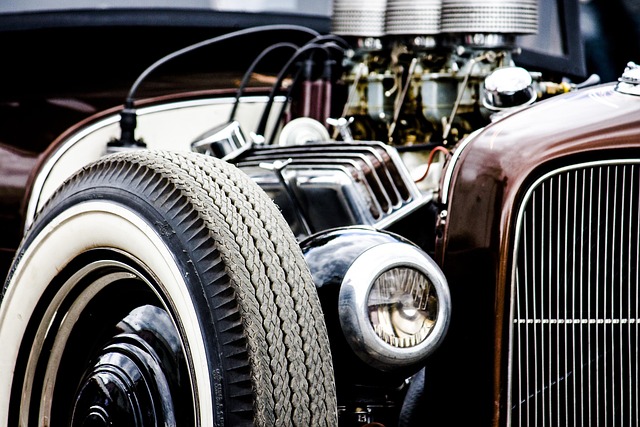

In the world of Rockport auto title loans, understanding the basics is crucial for making informed decisions. A Rockport auto title loan is a secured lending option where the title of your vehicle serves as collateral. This type of loan allows car owners to access financial assistance based on their vehicle’s value. The process involves borrowing money from a lender by using your vehicle’s ownership rights, ensuring repayment with interest. Once the loan is repaid, the title is returned to the borrower.

These loans are designed for individuals seeking quick and convenient funding, often providing a faster alternative to traditional bank loans. Loan terms vary, offering flexibility for borrowers. Additionally, some lenders may provide options for loan refinancing, allowing you to adjust repayment conditions if needed. It’s essential to explore different Rockport auto title loans services to find the best fit based on your financial needs and to ensure competitive interest rates and transparent terms.

Key Factors to Consider When Choosing a Lender

When choosing a lender for Rockport auto title loans, there are several key factors to consider. Firstly, ensure they offer competitive interest rates and flexible repayment terms tailored to your budget. This is crucial as it directly impacts the overall cost of the loan. Secondly, check if they provide transparent and straightforward lending processes with minimal hidden fees. A reputable lender should make it easy for you to understand the terms and conditions without any confusing jargon.

Additionally, verifying their licensing and regulatory compliance is essential. You want to deal with a licensed and insured lender who adheres to state laws governing car title loans in San Antonio or Rockport. This safeguard protects you from potential scams or unfair practices. Furthermore, reading customer reviews can give valuable insights into the lender’s reputation, customer service, and loan approval rates, especially for those seeking bad credit loans options.

Top Tips for Securing the Best Rockport Auto Title Loan Deal

When shopping for Rockport auto title loans, it’s crucial to compare lenders based on key factors that can significantly impact your financial health. Emergency Funding, same-day funding, and loan payoff terms vary widely among lenders, so thorough research is essential. Look for transparent loan agreements outlining interest rates, fees, and repayment schedules to avoid hidden costs.

Reputation and customer reviews are also vital indicators of a reliable lender. Opting for established Rockport auto title loans providers with positive feedback demonstrates their commitment to fair practices and customer satisfaction. Additionally, consider the flexibility of loan terms and whether the lender offers options for early payoff without penalties, allowing you greater control over your finances.

When seeking Rockport auto title loans, it’s crucial to choose a reputable lender that offers competitive rates and transparent terms. By understanding the basics of these loans, considering key factors like interest rates, repayment terms, and customer reviews, and following top tips for securing the best deal, you can make an informed decision. Remember, a little research can save you significant amounts in the long run when it comes to Rockport auto title loans.